What is Investment?

Meaning

"Never stop investing. Never stop improving. Never stop doing something new." Bob Parsons.

Investment is basically to allocate your money in the anticipation of getting some benefit from it in the future time.

Types of Investments

There are some definitions of common investment types

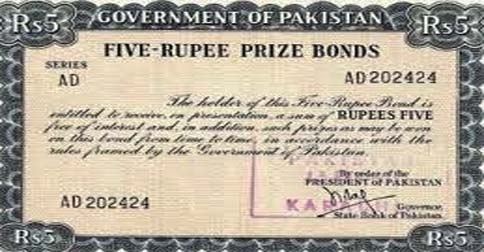

Bonds

"A bond is a debt investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time."

Stocks

"A stock is a type of security that signifies ownership in a corporation and represents a claim on part of the corporation's assets and earnings."

Mutual Funds

"A mutual fund is a professionally managed investment fund that pools money from many investors to purchase securities."

Real Estates

"Real estate refers to invest in land, as well as any physical property or improvements affixed to the land, including houses, buildings, landscaping, fencing, wells."

The Investment Process

"Anyone who is not investing now is missing a tremendous opportunity." Carlos Slim

Each person considers investing somewhere so that he can get some benefit from his investment in future. Normally people think about investing after their retirement, but that is a wrong approach. You should consider investing money as soon as you start earning to get more benefits in near and far future. The issue with investing is that not every individual has got knowledge about investment. Fruitful investment is not an easy job. Investment is a step by step process. Firstly, you need to be clear about your goals and needs.

Information gathering and analysis

When you have decided about investing your savings, the most important step is to check your personal financial inventory to see how much you have got and how much you are willing to invest. Now you need to think about your goals and objectives.

This step involves asking series of questions to you.

- What are the short and long-term financial objectives of your investment?

- If you face loss, do you have enough money to afford your expenses after loss?

- Do you have enough money for your retirement?

The next step is the time limit associated with your objectives and goals. For example, if you need money in near future than you should have sufficient cash as your backup. You need to do survey about all kinds of long and short term financial asset’s details. Normally in every family, there is one person who is interested in investment at an early age. Contact that person and get full knowledge about investing in financial assets. Read different financial reports of companies and learn about companies past trend. Visit the Stock exchange and meet brokers. Basically they can guide you properly about investment in local and international stocks and shares.

The Risk Factor

"An investor's worst enemy is not stock market but his own emotions."

Once you have gathered all information about investment and where to invest. Now you have wide range of investment opportunities where you can invest and earn. When you invest somewhere, there is one threat which is risk. There is always a chance that you lose everything or face a minor loss in investment.

Structuring your portfolio

Each financial asset, stocks, shares, mutual funds, cash equivalents has its own expected rate of return and its own risk factors. To avoid or minimize the risk, try to develop a mix of assets. Invest in different assets like invest some money in shares, mutual funds, bonds and any other asset. This balancing method includes analyzing the risk and return of each and every financial asset. This analysis is very important to structure your portfolio. This process will guide you to develop a diversified portfolio by mixing all kinds of asset classes. Continual research for new investment opportunities is also very important so that you can invest in new assets and earn some benefit from them as well.

Top Contributors

Related Articles

Muneeb Ahmed serves as the Director of CMACED- Centre for Entrepreneurship Development

- Ilmkidunya

- 10/Apr/2025

Strategies to Improve Computer Security for Small Businesses | Effective Cybersecurity Practices

- Ilmkidunya

- 07/Apr/2025

Former Provincial Minister Ibrahim Murad’s Efforts Boost Pakistan’s Meat Exports by 55% to $431M in 9 Months

- Team Ilmkidunya

- 24/May/2024

.gif)