Takaful is an Arabic word that means "guaranteeing each other". It is a system of Islamic insurance based on the principle of shared assistance called Taawun and Tabarru (gift, give away and donation) where risk is shared collectively. This is an agreement among a group of members or jointly guarantee among participants who agree to themselves against loss or damage to any of them as defined in the pact. Islamic finance system has been mainly developed in two further dimensions, Islamic banking and Takaful. Islamic banking is very much popular in Pakistan but Pakistani people not familiar with Takaful.

All the human beings are in constant danger of lot of losses and misfortunes as death, accident and losing any part of body, property and wealth loss in any kind of accident etc. There is a conventional insurance system which pays after any kind of disaster and misfortune. But in Islamic finance system there is no concept of this conventional system of insurance and Islam gives system of Takaful as the alternative of insurance system.

Islamic scholars believe that this conventional insurance system is against Islamic teaching due to involvement of riba (interest), maisir (gambling) and gharar (uncertainty). Takaful, the Islamic alternative to insurance is based on the idea and theory of social harmony, assistance and mutual assurance of losses of members. It is a deal among a group of persons who agree to jointly assure the loss or damage that may impose upon any of them, out of the fund they donate collectively. The Takaful contract so agreed usually involves the concepts of Mudarabah, Tabarru (to donate for benefit of others) and mutual sharing of losses with the overall objective of eradicating the element of doubt.

Takaful is not a new concept but its base is laid down in the system of “Aaqilah” that was an arrangement of communal help and assurance in some tribes in Arab at the time of Prophet Hazrat Muhammad S.A.W.W. In this system every one used to contribute something until the loss was covered. Islam accepted this principal of compensation and the communal responsibility.

The contract of Takaful provides harmony in respect of any misfortune in human life and loss to the business, wealth, health or property. The policyholders (Takaful partners) pay subscription to support and indemnify each other and share the profits earned from business conducted by the company with the subscribed funds. Takaful companies normally divide the contributions into two parts, i.e., donations for meeting mortality liability or losses of the fellow policyholders and the other part for investment. Accordingly, the clause of Tabarru is incorporated in the contract. How much of the contribution is meant for mortality liability and how much for investment account is based on a sound technical basis of mortality tables and other actuarial requirements. Both the accounts are invested and returns thereof distributed on Mudarabah principle between the participants and the Takaful operators. The profit attributable to the participants is credited into the two accounts separately. To describe from another angle, a Takaful contract may comprise clauses for either protection or savings/investments or both the benefits of protection as well as savings and investment. The protection part of Takaful works on the donation principle according to which individual rights are given up to indemnify the losses equally. In the Savings part, individual rights remain intact under Mudarabah principle and the contributions along with profit (net of expenses) are paid to the policyholders at the end of policy term or before, if required by him.

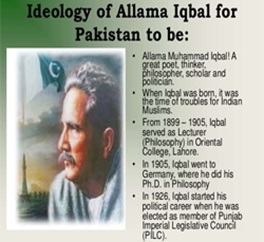

Takaful concept of Islamic finance system is not very much familiar in Pakistani business community. Riphah International University is organizing an international conference in Islamabad next year for the business and banking experts of Pakistan and also the students and scholars. In this International conference the world renowned Islamic scholars of business and finance would describe the different modes of Takaful and introduce this concept in Pakistan and also its benefits.

Top Contributors

Related Articles

Former Provincial Minister Ibrahim Murad’s Efforts Boost Pakistan’s Meat Exports by 55% to $431M in 9 Months

- Team Ilmkidunya

- 24/May/2024

Top 10 Questions People Ask About Prize Bonds Draw Schedule And Their Answers

- Mehran Ali

- 08/Jun/2021

.gif)