The Federation of All Pakistan Universities Academic Staff Associations (FAPUASA) has strongly urged the government to reinstate the 25% tax rebate for teachers and researchers. The association argues that educators deserve the same tax relief granted to cricketers participating in the ICC Champions Trophy 2025.

Background of the Tax Rebate Issue

In December 2024, the Federal Board of Revenue (FBR) revoked the longstanding 25% tax rebate for teachers and researchers. This decision led to significant salary deductions for academic staff, prompting concerns across the education sector.

Key Developments:

-

The tax rebate was removed despite prior assurances in the June 2024 budget.

-

Universities have been directed to recover tax arrears from the past three years.

-

Educators face increased financial burdens due to the tax policy shift.

FAPUASA’s Stand Against Tax Discrimination

FAPUASA President Dr. Amjad Abbas Magsi has criticized the government’s approach, highlighting what he calls "preferential treatment" towards international athletes while neglecting the financial concerns of educators.

FAPUASA’s Major Concerns:

-

Teachers and researchers play a crucial role in national development but are being ignored.

-

The government has exempted cricketers from taxes for the ICC Champions Trophy 2025, while university teachers face higher deductions.

-

Increased taxation is discouraging talent from joining the education sector.

Financial Impact on Educators

The revocation of the tax rebate has led to substantial salary deductions. Many teachers now struggle with financial challenges due to sudden tax recoveries.

| Category | Previous Tax Rate | New Tax Rate | Annual Impact |

|---|---|---|---|

| University Professors | Reduced by 25% | Full Tax Applied | Increased Salary Deduction |

| Researchers | Reduced by 25% | Full Tax Applied | Increased Salary Deduction |

| Cricketers (2025 ICC) | Exempted | Exempted | No Taxation |

Higher Education Crisis: A Looming Threat

FAPUASA has also raised alarms about the deteriorating state of higher education in Pakistan. The removal of tax benefits is only one of many challenges faced by universities.

Other Major Issues:

-

Underfunding: Public-sector universities suffer from insufficient budget allocations.

-

Bureaucratic Interference: Administrative complexities hinder institutional autonomy.

-

Governance Challenges: Recent controversial changes in university governance have further destabilized the sector.

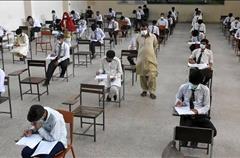

Nationwide Protests in Response to the Policy

FAPUASA has warned the government of nationwide demonstrations if the tax rebate is not reinstated. University teachers have already begun protests against the FBR’s decision.

Demands by FAPUASA:

-

Immediate restoration of the 25% tax rebate.

-

Reconsideration of policies affecting university teachers' financial stability.

-

Fair tax policies without discrimination against educators.

-

Increased investment in higher education to ensure quality learning.

.gif)