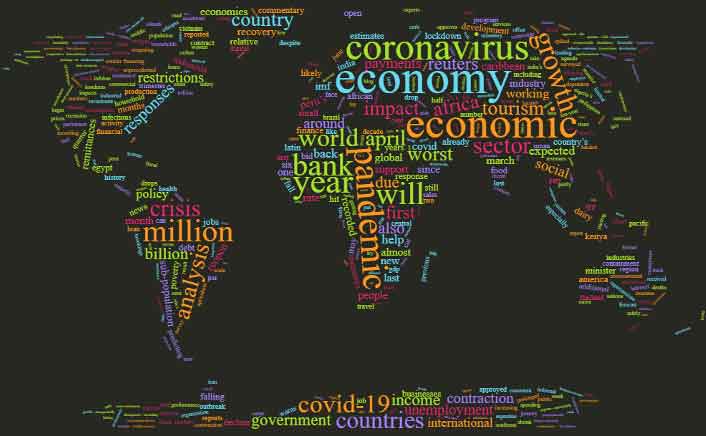

COVID-19 pandemic has spread with alarming speed, infecting millions and bringing economic activity to a near-standstill as countries imposed tight restrictions on movement to halt the spread of the virus. The economies of many countries have been shattered by the pandemic. It’s hard to tell the exact figure of the losses faced by economies of different countries. The economic damage is already evident and represents the largest economic shock the world has experienced in decades. Major victims of the COVID-19 outbreak are micro, small, and medium-sized enterprises that work on a smaller scale and had had a very limited number of resources.

The Global Economic Outlook During the COVID-19 Pandemic

The Covid-19 pandemic is unprecedented in its global reach and impact, posing formidable challenges to policymakers and the empirical analysis of its direct and indirect effects within the interconnected global economy. The Covid-19 pandemic is a global shock ‘like no other’ involving simultaneous disruptions to both supply and demand in an interconnected world economy. On the supply side, infections reduce labor supply and productivity, while lockdowns, business closures, and social distancing also cause supply disruptions. On the demand layoffs, loss of income, unemployment, and worsening economic prospects reduce household consumption and firms’ investment.

The extreme uncertainty about the path, duration, magnitude, and impact of the pandemic could pose a vicious cycle of dampening business and consumer confidence and tightening financial conditions, which could lead to job losses and lesser investments. This pandemic took a huge toll on the global GDP and the whole world is facing the deepest global recession in decades, despite the extraordinary efforts of governments to counter the downturn with fiscal and monetary policy support.

How The Pandemic Has Changed The World Economy

Every region is subject to substantial growth downgrades. These downturns are expected to reverse years of progress toward development goals and tip tens of millions of people back into extreme poverty. Global stock markets have also suffered dramatic falls due to the coronavirus outbreak, stock prices suffered some serious falls because of the coronavirus. The economic damage caused by the COVID-19 pandemic is largely driven by a fall in demand, meaning that fewer consumers are willing to purchase the goods and services available in the global economy. This dynamic can be seen in heavily affected industries such as travel and tourism. Many countries like Dubai and Thailand that heavily relayed on their travel and tourism industry suffered a huge loss of income and their annual GDP took a huge dip downward. Because of this, there was a shortage of cash inflow and to counter it many of the organizations had to make their staff redundant and it created huge unemployment in those countries. To slow the spread of the virus, countries have placed restrictions on travel and many people could not purchase flights for holidays or business trips. This reduction in consumer demand was the reason why airlines lost planned revenue and as a result, they had to cut their expenses by reducing the number of flights they operate. Without government assistance, eventually, airlines will also need to lay off staff to cut more costs.

The same dynamic applies to other industries, for example with falling demand for oil and new cars as daily commutes, social events and holidays are no longer possible. As companies start to reduce employment to make up for lost revenue, the worry is that this will create a downward economic spiral when these newly unemployed workers can no longer afford to purchase as many goods and services as before. Pressure on weak health care systems, loss of trade and tourism, dwindling remittances, subdued capital flows, and tight financial conditions amid mounting debt.

Economic Consequences of Covid-19

Exporters of energy or industrial commodities are also affected by COVID-19. The pandemic and efforts to contain it have triggered an unprecedented collapse in oil demand and a crash in oil prices. In the international market, the oil was selling at such a lower rate that the barrel in which the oil was put in was more expensive than the oil. Reduction in the price of oil also affected the prices of commodities related to it. Demand for metals and transport-related commodities such as rubber and platinum used for vehicle parts has also tumbled.

While agriculture markets are well supplied globally, trade restrictions and supply chain disruptions could yet raise food security issues in some places. The agriculture market would also suffer greatly if this virus continues to spread at the rates at which it’s spreading. Consumer spending, including higher education spending, will continue to decline as a result of economic contractions in a post‐COVID‐19 world. Families facing an uncertain economic future will be reluctant to send their children to high‐priced schools which will cause the literacy rate to decline. In the face of this disquieting outlook, the immediate priority for policymakers is to address the health crisis and contain the short-term economic damage. Over the longer term, authorities need to undertake comprehensive reform programs to improve the fundamental drivers of economic growth once the crisis lifts.

Policies to rebuild both in the short and long term entail strengthening health services and putting in place targeted stimulus measures to help reignite growth, including support for the private sector and getting money directly to people. During the mitigation period, countries should focus on sustaining economic activity with support for households, firms, and essential services. Global coordination and cooperation—of the measures needed to slow the spread of the pandemic, and of the economic actions needed to alleviate the economic damage, including international support—provide the greatest chance of achieving public health goals and enabling a robust global recovery.

Recovery From The Crisis

Finally, there is the fact that the crisis may have a clear end date when all restrictions can be lifted – this seems to be possible when the majority of the global population is vaccinated against COVID-19. It could then enable the global economy to experience a sharp rebound once the pandemic is over. E-commerce, food retail, and the healthcare industry provide at least some economic growth to offset the damage. Also, a crisis-induced movement to online activities helps regain some economic growth. The fact that pandemic is still going on is still concerning to the global economy but with vaccination around the corner, there’s hope that the situation will turn around.

Mehran Ali

.gif)