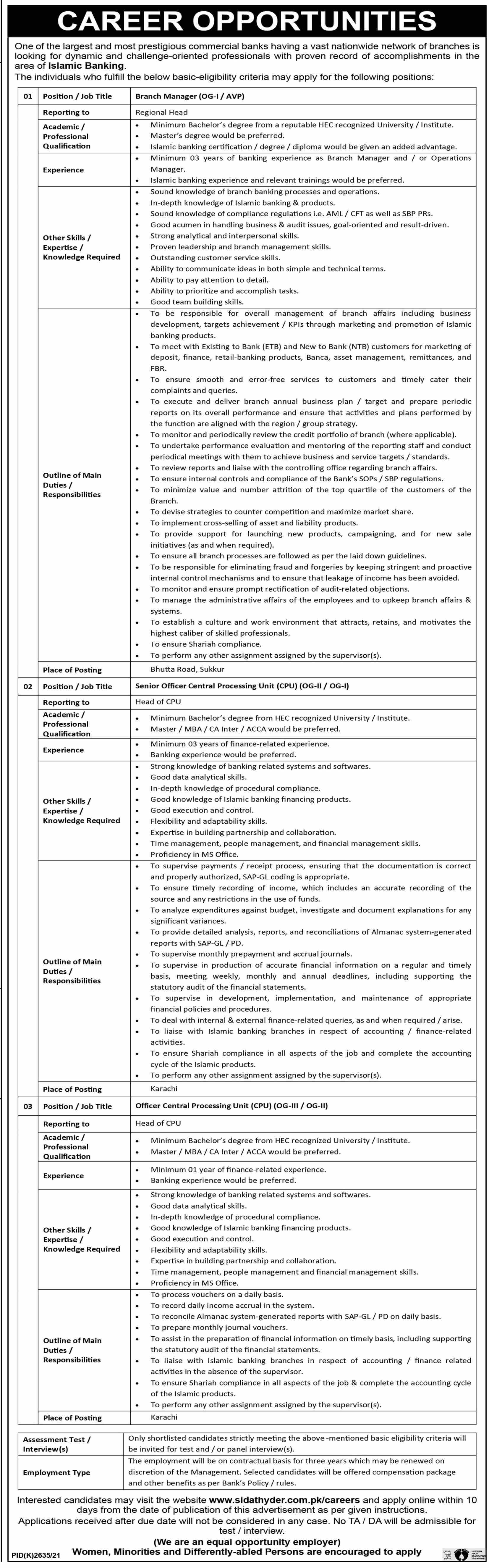

| 01 |

Position / Job Title |

Branch Manager (OG-1 / AVP) |

| |

Reporting to |

Regional Head |

| Academic / Professional Qualification |

- Minimum Bachelor's degree from a reputable HEC recognized University / Institute.

- Master's degree would be preferred.

- Islamic banking certification / degree / diploma would be given an added advantage.

|

| Experience |

- Minimum 03 years of banking experience as Branch Manager and / or Operations Manager.

- Islamic banking experience and relevant trainings would be preferred.

|

Other Skills /

Expertise /

Knowledge Required |

- Sound knowledge of branch banking processes and operations.

- In-depth knowledge of Islamic banking & products.

- Sound knowledge of compliance regulations i.e. AML / CFT as well as SBP PRs.

- Good acumen in handling business & audit issues, goal-oriented and result-driven.

- Strong analytical and interpersonal skills.

- Proven leadership and branch management skills.

- Outstanding customer service skills.

- Ability to communicate ideas in both simple and technical terms.

- Ability to pay attention to detail.

- Ability to prioritize and accomplish tasks.

- Good team building skills.

|

| Outline of Main Duties / Responsibilities |

- To be responsible for overall management of branch affairs including business

development, targets achievement / KPIs through marketing and promotion of Islamic banking products.

- To meet with Existing to Bank (ETB) and New to Bank (NTB) customers for marketing of deposit, finance, retail-banking products, Banca, asset management, remittances, and FBR.

- To ensure smooth and error-free services to customers and timely cater their

complaints and queries.

- To execute and deliver branch annual business plan / target and prepare periodic reports on its overall performance and ensure that activities and plans performed by the function are aligned with the region / group strategy.

- To monitor and periodically review the credit portfolio of branch (where applicable).

- To undertake performance evaluation and mentoring of the reporting staff and conduct periodical meetings with them to achieve business and service targets / standards.

- To review reports and liaise with the controlling office regarding branch affairs.

- To ensure internal controls and compliance of the Bank's SOPs / SBP regulations.

- To minimize value and number attrition of the top quartile of the customers of the Branch.

- To devise strategies to counter competition and maximize market share.

- To implement cross-selling of asset and liability products.

- To provide support for launching new products, campaigning, and for new sale

initiatives (as and when required).

- To ensure all branch processes are followed as per the laid down guidelines.

- To be responsible for eliminating fraud and forgeries by keeping stringent and proactive

internal control mechanisms and to ensure that leakage of income has been avoided.

- To monitor and ensure prompt rectification of audit-related objections.

- To manage the administrative affairs of the employees and to upkeep branch affairs & systems.

- To establish a culture and work environment that attracts, retains, and motivates the highest caliber of skilled professionals.

- To ensure Shariah compliance.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

Bhutta Road, Sukkur |

| 02 |

Position / Job Title |

Senior Officer Central Processing Unit (CPU) (0G-11/ OG-I) |

| |

Reporting to |

Head of CPU |

| Academic / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master / MBA / CA Inter / ACCA would be preferred.

|

| Experience |

- Minimum 03 years of finance-related experience.

- Banking experience would be preferred.

|

Other Skills /

Expertise /

Knowledge Required |

- Strong knowledge of banking related systems and softwares.

- Good data analytical skills.

- In-depth knowledge of procedural compliance.

- Good knowledge of Islamic banking financing products.

- Good execution and control.

- Flexibility and adaptability skills.

- Expertise in building partnership and collaboration.

- Time management, people management, and financial management skills.

- Proficiency in MS Office.

|

Outline of Main Duties /

Responsibilities |

- To supervise payments / receipt process, ensuring that the documentation is correct and properly authorized, SAP-GL coding is appropriate.

- To ensure timely recording of income, which includes an accurate recording of the source and any restrictions in the use of funds.

- To analyze expenditures against budget, investigate and document explanations for any significant variances.

- To provide detailed analysis, reports, and reconciliations of Almanac system-generated reports with SAP-GL / PD.

- To supervise monthly prepayment and accrual journals.

- To supervise in production of accurate financial information on a regular and timely

basis, meeting weekly, monthly and annual deadlines, including supporting the

statutory audit of the financial statements.

- To supervise in development, implementation, and maintenance of appropriate

financial policies and procedures.

- To deal with internal & external finance-related queries, as and when required / arise.

- To liaise with Islamic banking branches in respect of accounting / finance-related

activities.

- To ensure Shariah compliance in all aspects of the job and complete the accounting cycle of the Islamic products.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

Karachi |

| 03 |

Position / Job Title |

Officer Central Processing Unit (CPU) (0G-111/ 0G-11) |

| |

Reporting to |

Head of CPU |

| Academic / Professional Qualification |

- Minimum Bachelor's degree from HEC recognized University / Institute.

- Master / MBA / CA Inter / ACCA would be preferred.

|

| Experience |

- Minimum 01 year of finance-related experience.

- Banking experience would be preferred.

|

Other Skills /

Expertise /

Knowledge Required |

- Strong knowledge of banking related systems and softwares.

- Good data analytical skills.

- In-depth knowledge of procedural compliance.

- Good knowledge of Islamic banking financing products.

- Good execution and control.

- Flexibility and adaptability skills.

- Expertise in building partnership and collaboration.

- Time management, people management and financial management skills.

- Proficiency in MS Office.

|

| Outline of Main Duties / Responsibilities |

- To process vouchers on a daily basis.

- To record daily income accrual in the system.

- To reconcile Almanac system-generated reports with SAP-GL / PD on daily basis.

- To prepare monthly journal vouchers.

- To assist in the preparation of financial information on timely basis, including supporting the statutory audit of the financial statements.

- To liaise with Islamic banking branches in respect of accounting / finance related

activities in the absence of the supervisor.

- To ensure Shariah compliance in all aspects of the job & complete the accounting cycle of the Islamic products.

- To perform any other assignment assigned by the supervisor(s).

|

| Place of Posting |

Karachi |

| Assessment Test / Interview(s) |

Only shortlisted candidates strictly meeting the above-mentioned basic eligibility criteria will be invited for test and / or panel interview(s). |

| Employment Type |

The employment will be on contractual basis for three years which may be renewed on discretion of the Management. Selected candidates will be offered compensation package and other benefits as per Bank's Policy / rules. |

.gif)