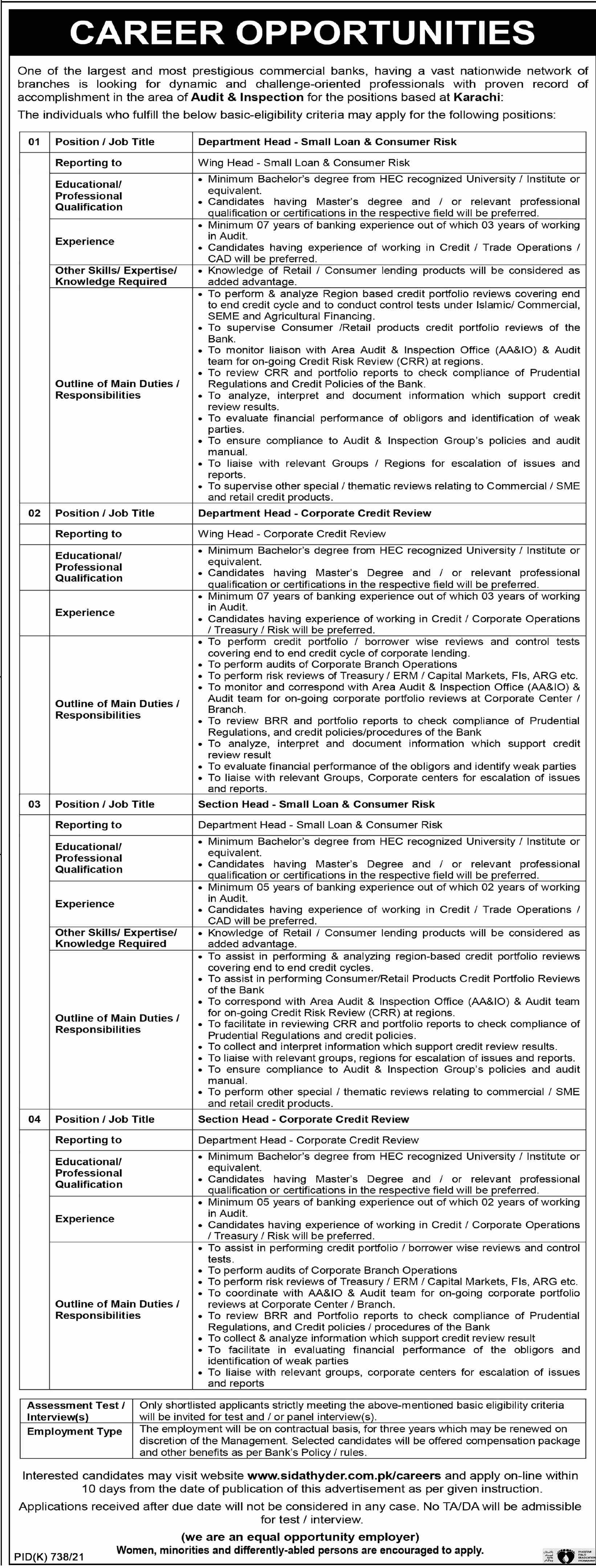

| 01 |

Position / Job Title |

Department Head - Small Loan & Consumer Risk |

| |

Reporting to |

Wing Head - Small Loan & Consumer Risk |

Educational/

Professional

Qualification

equivalent. |

- Minimum Bachelor's degree from HEC recognized University / Institute or

- Candidates having Master's degree and / or relevant professional qualification or certifications in the res ective field will be preferred.

|

| Experience |

- Minimum 07 years of banking experience out of which 03 years of working in Audit.

- Candidates having experience of working in Credit / Trade Operations /CAD will be preferred.

|

Other Skills/ Expertise/

Knowledge Required |

- Knowledge of Retail / Consumer lending products will be considered as added advantage

|

Outline of Main Duties /

Responsibilities |

- To perform & analyze Region based credit portfolio reviews covering end to end credit cycle and to conduct control tests under Islamic/ Commercial, SEME and Agricultural Financing.

- To supervise Consumer /Retail products credit portfolio reviews of the Bank.

- To monitor liaison with Area Audit & Inspection Office (AA&10) & Audit team for on-going Credit Risk Review (CRR) at regions.

- To review CRR and portfolio reports to check compliance of Prudential Regulations and Credit Policies of the Bank.

- To analyze, interpret and document information which support credi t review results.

- To evaluate financial performance of obligors and identification of weak parties.

- To ensure compliance to Audit & Inspection Group's policies and audit manual.

- To liaise with relevant Groups / Regions for escalation of issues and reports.

- To supervise other special / thematic reviews relating to Commercial / SME and retail credit products.

|

| 02 |

Position / Job Title |

Department Head - Corporate Credit Review |

| |

Reporting to |

Wing Head - Corporate Credit Review |

| |

Educational/

Professional

Qualification

equivalent. |

- Minimum Bachelor's degree from HEC recognized University / Institute or

- Candidates having Master's Degree and / or relevant professional qualification or certifications in the respective field will be preferred.

|

| |

Experience

in Audit. |

- Minimum 07 years of banking experience out of which 03 years of working

- Candidates having experience of working in Credit / Corporate Operations/ Treasury / Risk will be preferred.

|

| |

Outline of Main Duties /

Responsibilities |

- To perform credit portfolio / borrower wise reviews and control tests covering end to end credit cycle of corporate lending.

- To perform audits of Corporate Branch Operations

- To perform risk reviews of Treasury / ERM / Capital Markets, Fls, ARG etc.

- To monitor and correspond with Area Audit & Inspection Office (AA&10) & Audit team for on-going corporate portfolio reviews at Corporate Center / Branch.

- To review BRR and portfolio reports to check compliance of Prudential Regulations, and credit policies/procedures of the Bank

- To analyze, interpret and document information which support credit review result

- To evaluate financial performance of the obligors and identify weak parties

- To liaise with relevant Groups, Corporate centers for escalation of issues and reports.

|

| 03 |

Position / Job Title |

Section Head - Small Loan & Consumer Risk |

| |

Reporting to |

Department Head - Small Loan & Consumer Risk |

Educational/

Professional

Qualification

equivalent. |

- Minimum Bachelor's degree from HEC recognized University / Institute or

- Candidates having Master's Degree and / or relevant profession qualification or certifications in the respective field will be preferred.

|

| Experience |

- Minimum 05 years of banking experience out of which 02 years of working in Audit.

- Candidates having experience of working in Credit / Trade Operations / CAD will be preferred.

|

Other Skills/ Expertise/

Knowledge Required |

- Knowledge of Retail / Consumer lending products will be considered as added advantage.

|

Outline of Main Duties /

Responsibilities |

- To assist in performing & analyzing region-based credit portfolio reviews covering end to end credit cycles.

- To assist in performing Consumer/Retail Products Credit Portfolio Reviews of the Bank

- To correspond with Area Audit & Inspection Office (AA&10) & Audit team for on-going Credit Risk Review (CRR) at regions.

- To facilitate in reviewing CRR and portfolio reports to check compliance of Prudential Regulations and credit policies.

- To collect and interpret information which support credit review results.

- To liaise with relevant groups, regions for escalation of issues and reports.

- To ensure compliance to Audit & Inspection Group's policies and audit manual.

- To perform other special / thematic reviews relating to commercial / SME and retail credit products. Section Head - Corporate Credit Review

|

| 04 |

Position / Job Title |

Section Head Corporate Credit Review |

| |

Reporting to |

Department Head - Corporate Credit Review |

Educational/

Professional

Qualification

equivalent. |

- Minimum Bachelor's degree from HEC recognized University / Institute or

- Candidates having Master's Degree and / or relevant professional qualification or certifications in the respective field will be preferred.

|

| Experience |

- Minimum 05 years of banking experience out of which 02 years of working in Audit.

- Candidates having experience of working in Credit / Corporate Operations / Treasury / Risk will be preferred.

|

Outline of Main Duties /

Responsibilities |

- To assist in performing credit portfolio / borrower wise reviews and control tests.

- To perform audits of Corporate Branch Operations

- To perform risk reviews of Treasury / ERM / Capital Markets, As, ARG etc.

- To coordinate with AA&IO & Audit team for on-going corporate portfolio reviews at Corporate Center / Branch.

- To review BRR and Portfolio reports to check compliance of Prudential Regulations, and Credit policies / procedures of the Bank

- To collect & analyze information which support credit review result

- To facilitate in evaluating financial performance of the obligors and identification of weak parties

- To liaise with relevant groups, corporate centers for escalation of issues and reports

|

Assessment Test /

Interview(s) |

Only shortlisted applicants strictly meeting the above-mentioned basic eligibility criteria

will be invited for test and / or panel interview(s). |

| Employment Type |

The employment will be on contractual basis, for three years which may be renewed on discretion of the Management. Selected candidates will be offered compensation package and other benefits as per Bank's Policy / rules. |