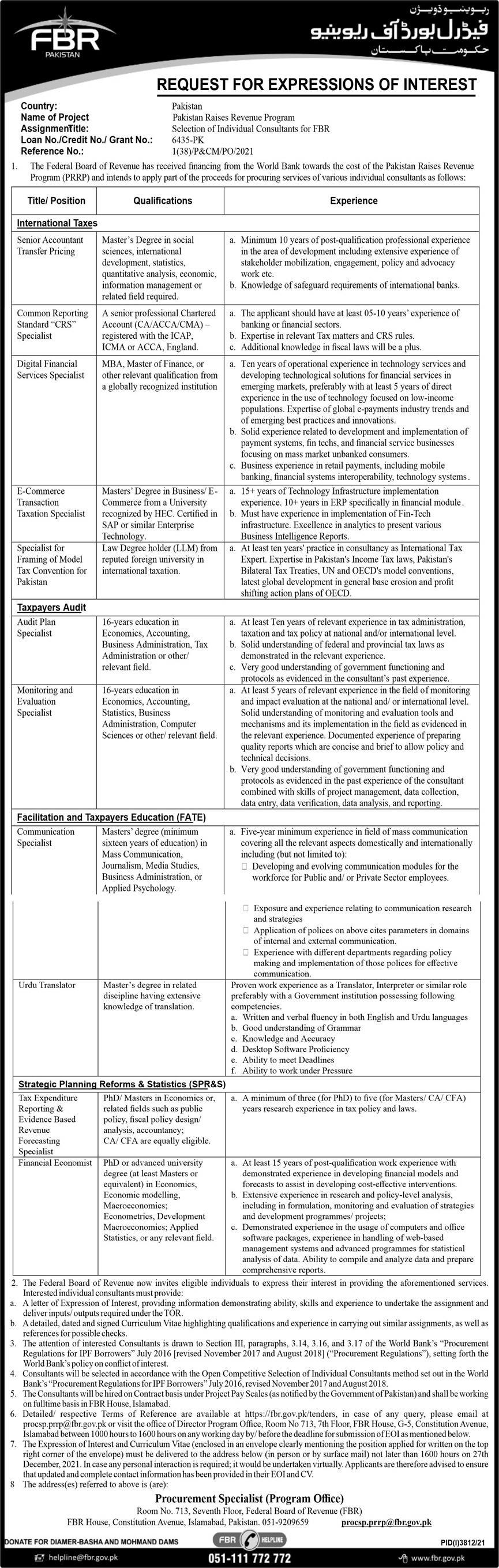

- The Federal Board of Revenue has received financing from the World Bank towards the cost of the Pakistan Raises Revenue Program (PRRP) and intends to apply part of the proceeds for procuring services of various individual consultants as follows:

Title/ Position Qualifications Experience International Taxes Senior Accountant

Transfer PricingMaster's Degree in social sciences, international development, statistics, quantitative analysis, economic, information management or related field required. - Minimum 10 years of post-qualification professional experience in the area of development including extensive experience of stakeholder mobilization, engagement, policy and advocacy work etc.

- Knowledge of safeguard requirements of international banks.

Common Reporting Standard "CRS" Specialist A senior professional Chartered Account (CA/ACCA/CMA) — registered with the ICAP, ICMA or ACCA, England. - The applicant should have at least 05-10 years' experience of banking or financial sectors.

- Expertise in relevant Tax matters and CRS rules.

- Additional knowledge in fiscal laws will be a plus.

Digital Financial Services Specialist MBA, Master of Finance, or other relevant qualification from a globally recognized institution - Ten years of operational experience in technology services and developing technological solutions for financial services in emerging markets, preferably with at least 5 years of direct experience in the use of technology focused on low-income populations. Expertise of global c-payments industry trends and of emerging best practices and innovations.

- Solid experience related to development and implementation of payment systems, fin techs, and financial service businesses focusing on mass market unbanked consumers.

- Business experience in retail payments, including mobile banking, financial systems interoperability, technology systems .

E-Commerce Transaction Taxation Specialist Masters' Degree in Business/ E- Commerce from a University recognized by FIEC. Certified in SAP or similar Enterprise Technology. - 15+ years of Technology Infrastructure implementation experience. 10+ years in ERP specifically in financial module .

- Must have experience in implementation of Fin-Tech infrastructure. Excellence in analytics to present various Business Intelligence Reports.

Specialist for Framing of Model Tax Convention for Pakistan Law Degree holder (LLM) from reputed foreign university in international taxation. - At least ten years' practice in consultancy as International Tax Expert. Expertise in Pakistan's Income Tax laws, Pakistan's Bilateral Tax Treaties, UN and OECD's model conventions, latest global development in general base erosion and profit shifting action plans of OECD.

Taxpayers Audit Audit Plan Specialist 16-years education in Economics, Accounting, Business Administration, Tax Administration or other/ relevant field. - At least Ten years of relevant experience in tax administration, taxation and tax policy at national and/or international level.

- Solid understanding of federal and provincial tax laws as demonstrated in the relevant experience.

- Very good understanding of government functioning and protocols as evidenced in the consultant's past experience.

Monitoring and Evaluation Specialist I 6-years education in Economics, Accounting, Statistics, Business Administration, Computer Sciences or other/ relevant field. - At least 5 years of relevant experience in the field of monitoring and impact evaluation at the national and/ or international level. Solid understanding of monitoring and evaluation tools and mechanisms and its implementation in the field as evidenced in the relevant experience. Documented experience of preparing quality reports which are concise and brief to allow policy and technical decisions.

- Very good understanding of government functioning and protocols as evidenced in the past experience of the consultant combined with skills of project management, data collection, data entry, data verification, data analysis, and reporting.

Facilitation and Taxpayers Education (FATE) Communication Specialist Masters' degree (minimum sixteen years of education) in Mass Communication, Journalism, Media Studies, Business Administration, or Applied Psychology. - Five-year minimum experience in field of mass communication covering all the relevant aspects domestically and internationally including (but not limited to):

- Developing and evolving communication modules for the workforce for Public and/ or Private Sector employees.

- Exposure and experience relating to communication research and strategies

- Application of polices on above cites parameters in domains of internal and external communication.

- Experience with different departments regarding policy making and implementation of those polices for effective communication.

Urdu Translator Master's degree in related discipline having extensive knowledge of translation. Proven work experience as a Translator, Interpreter or similar role preferably with a Government institution possessing, tbllowing competencies. - Written and verbal fluency in both English and Urdu languages

- Good understanding of Grammar

- Knowledge and Accuracy

- Desktop Software Proficiency

- Ability to meet Deadlines

- Ability to work under Pressure

Strategic Planning Reforms & Statistics (SPR&S) Tax Expenditure Reporting & Evidence Based Revenue Forecasting Specialist PhD/ Masters in Economics or, related fields such as public policy, fiscal policy design/ analysis, accountancy; CA/ CFA are equally eligible. - A minimum of three (for PhD) to five (for Masters/ CA/ CFA) years research experience in tax policy and laws.

Financial Economist PhD or advanced university degree (at least Masters or equivalent) in Economics, Economic modelling, Macroeconomics; Econometrics, Development Macroeconomics; Applied Statistics, or any relevant field. - At least 15 years of post-qualification work experience with demonstrated experience in developing financial models and forecasts to assist in developing cost-effective interventions.

- Extensive experience in research and policy-level analysis, including in formulation, monitoring and evaluation of strategies and development programmes/ projects;

- Demonstrated experience in the usage of computers and office software packages, experience in handling of web-based management systems and advanced programmes for statistical analysis of data. Ability to compile and analyze data and prepare comprehensive reports.

- The Federal Board of Revenue now invites eligible individuals to express their interest in providing the aforementioned services. Interested individual consultants must provide:

- A letter of Expression of Interest, providing information demonstrating ability, skills and experience to undertake the assignment and deliver inputs/ outputs required under the TOR.

- A detailed, dated and signed Curriculum Vitae highlighting qualifications and experience in carrying out similar assignments, as well as references for possible checks.

- The attention of interested Consultants is drawn to Section III, paragraphs, 3.14, 3.16, and 3.17 of the World Bank's "Procurement Regulations for IPF Borrowers" July 2016 I revised November 2017 and August 20181 ("Procurement Regulations"), setting forth the World Bank's policy on conflict of interest.

- Consultants will be selected in accordance with the Open Competitive Selection of Individual Consultants method set out in the World Bank's "Procurement Regulations for IPF Borrowers" July 2016, revised November 2017 and August 2018.

- The Consultants will be hired on Contract basis under Project Pay Scales (as notified by the Government of Pakistan) and shall be workinp, on fulltime basis in FBR House, Islamabad.

- Detailed/ respective Terms of Reference are available at https://fbr.gov.pk/tenders, in case of any query, please email at procsp.prrp@lbr.gov.pk or visit the office of Director Program Office, Room No 713, 7th Floor, FBR House, G-5, Constitution Avenue, Islamabad between 1000 hours to 1600 hours on any working day by/ before the deadline for submission ofE0I as mentioned below.

- The Expression of Interest and Curriculum Vitae (enclosed in an envelope clearly mentioning the position applied for written on the top right corner of the envelope) must be delivered to the address below (in person or by surface mail) not later than 1600 hours on 27th December, 2021.1n case any personal interaction is required; it would be undertaken virtually. Applicants are therefore advised to ensure that updated and complete contact information has been provided in their EOI and CV.

- The address(es) referred to above is (are):

Procurement Specialist (Program Office)

Room No. 713, Seventh Floor, Federal Board of Revenue (FBR)

FBR House, Constitution Avenue, Islamabad, Pakistan. 051-9209659

procsp.prrprii fbr.gov.pli

Share your comments questions here

Sort By:

X

.gif)