The latest StatCounter Global Stats report for 2023-2024 sheds light on the competitive smartphone market in Pakistan, revealing the preferences of consumers and highlighting the performance of leading brands. Among the contenders, Infinix has emerged as the front-runner, dominating the market with innovative features, consumer-centric strategies, and local production capabilities. This article explores the key statistics, market dynamics, and factors driving Infinix's success in Pakistan.

Market Share Overview

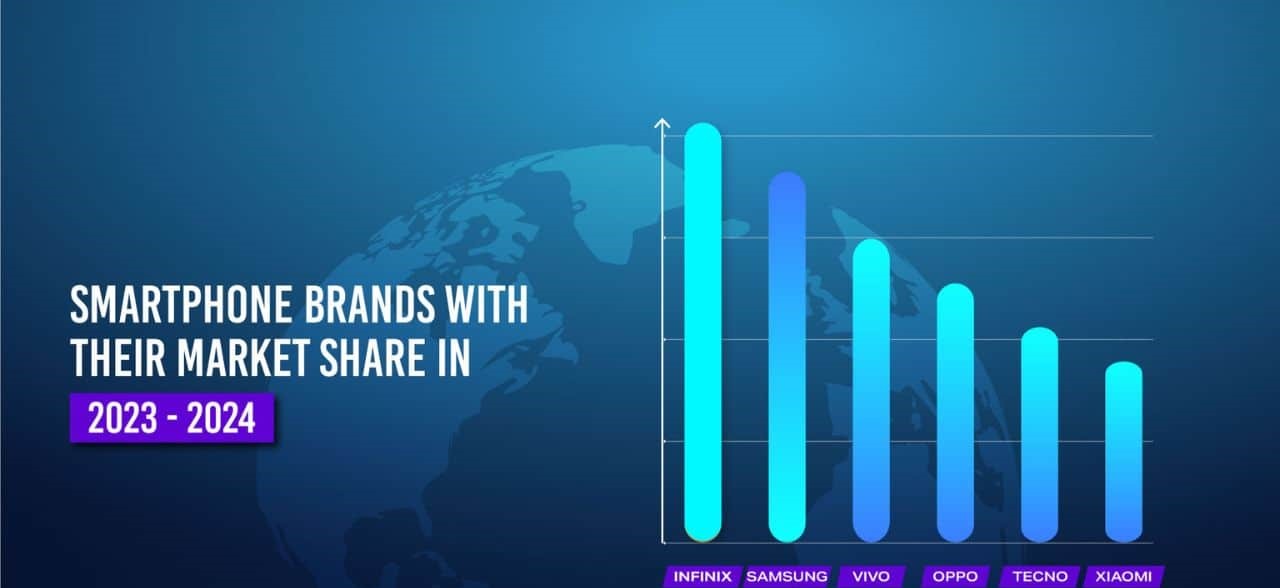

The report highlights the market shares of the top six smartphone brands in Pakistan:

| Brand | Market Share (%) |

|---|---|

| Infinix | 16.53 |

| Samsung | 15.66 |

| Vivo | 13.46 |

| OPPO | 11.16 |

| Tecno | 10.57 |

| Xiaomi | 9.24 |

The competition remains fierce, with Infinix leading the market at 16.53% and Samsung following closely at 15.66%. Vivo, OPPO, Tecno, and Xiaomi also retain significant portions, catering to a diverse consumer base.

Why Infinix Leads the Market

1. Consumer-Centric Approach

Infinix has consistently focused on delivering smartphones that cater to diverse consumer needs. By incorporating advanced features, stylish designs, and cutting-edge technology, the brand has created products that resonate with Pakistani consumers.

2. Local Production and Adaptability

In 2022, import restrictions on smartphones prompted Infinix to establish local production facilities in Pakistan. This strategic move not only ensured uninterrupted supply but also solidified consumer trust by demonstrating a commitment to the local market.

3. Innovative Features

Infinix integrates features that appeal to a broad audience, including:

- High-resolution cameras for photography enthusiasts.

- Large battery capacities to cater to long-lasting usage.

- Budget-friendly flagship devices for premium experiences at competitive prices.

4. Effective Marketing and Retail Presence

The brand’s impactful marketing campaigns and expansive retail presence across Pakistan have played a crucial role in boosting visibility and sales. Promotions and advertisements focus on affordability, innovation, and style—key factors for consumers in the region.

Competitive Landscape

Samsung: The Runner-Up

With a market share of 15.66%, Samsung remains a dominant player, leveraging its global reputation, wide range of offerings, and durable products. Samsung appeals to both premium users and mid-range buyers, maintaining its strong foothold in the market.

Vivo: Steady Growth

Holding the third position with 13.46%, Vivo has gained traction by emphasizing sleek designs and camera-centric smartphones. It has consistently delivered products that blend functionality with aesthetic appeal.

OPPO: Style and Innovation

OPPO ranks fourth with 11.16%, driven by its focus on camera technology and stylish designs. The brand appeals to younger consumers who prioritize high-quality photography and innovative features.

Tecno and Xiaomi: Value-Oriented Devices

- Tecno (10.57%): Known for budget-friendly devices, Tecno focuses on providing high-performance smartphones for price-sensitive consumers.

- Xiaomi (9.24%): Xiaomi combines affordability with advanced technology, carving a niche among tech enthusiasts who seek value for money.

Key Trends Shaping the Market

1. Consumer Preferences

Pakistani consumers prioritize smartphones that offer a combination of performance, style, and affordability. Brands that align their offerings with these preferences are more likely to succeed.

2. Innovation and Technology

With increased competition, innovation has become a differentiating factor. Brands like Infinix and Vivo invest heavily in research and development to introduce new features that captivate consumers.

3. Local Production and Accessibility

Local production facilities, as seen with Infinix, enable brands to adapt swiftly to market conditions while reducing costs. This strategy has proven essential in navigating import restrictions and economic challenges.

4. Effective Marketing Strategies

Innovative advertising campaigns and strong distribution networks allow brands to maximize reach and create a lasting impact on consumers.

Factors Driving Infinix's Success

Infinix has established itself as the preferred smartphone brand in Pakistan due to the following:

- Diverse Portfolio: Offers a variety of models across different price ranges.

- Focus on Youth: Targets younger consumers with stylish designs and high-performance features.

- Commitment to Innovation: Regularly introduces smartphones with cutting-edge technology.

- Strong Local Presence: Maintains an extensive retail network and localized production facilities.

Related Articles

-

Ilmkidunya 26/Jun/2025

How to Prepare for Competitive Exams Effectively

-

Ilmkidunya 10/Jun/2025

From Curiosity to Career A Purpose-Driven Journey Through the 4D Growth Framework

-

Ilmkidunya 10/Jun/2025

The Ethics of Artificial Intelligence in Everyday Life

-

Ilmkidunya 30/May/2025

Over 1 Billion Users: Meta AI Sets New Standard in AI Technology

-

ilmkidunya 27/May/2025

AI in Education – Will Students Stop Doing Homework in the Future?

-

ilmkidunya 27/May/2025

Tech Skills That Will Never Go Out of Demand

-

Ilmkidunya 12/May/2025

Mind Mapping for Smarter Studying: A Visual Learning Guide

-

Ilmkidunya 09/May/2025

How Computers Might Solve Problems We Don’t Even Understand Yet

-

Ilmkidunya 08/May/2025

Solving Compatibility Issues in Cross-Platform App Development

-

Ilmkidunya 08/May/2025

How Agile Methodologies Solve Project Management Problems

.gif)

.png)